do you pay corporation tax on dividends

Think of pre-tax profit like a flower pot with a hole in it. Ad Get the benefit of tax research and calculation experts with Avalara AvaTax software.

|

| Dividend Tax Peter Rayney |

An S corporation is not subject to corporate tax.

. Working out tax on dividends. Corporation Tax is levied on the profits of a company earned in a fiscal period that should not exceed 53 weeks. Paying a dividend doesnt reduce your companys corporation tax bill. Companies pay Corporation Tax on its profits before dividends are distributed so paying a dividend doesnt affect your.

Corporation tax is payable on the whole profit. Not everybody realizes that when companies pay out dividends on their excess cash it leads to profits being taxed twice. Avalara AvaTax can help you automate sales tax rate calculation and filing preparation. But note that distributions within CTA10S1000 1 E and F non-dividend distributions comprising interest and other distributions out of assets in respect of non-commercial and special.

How much tax do you pay on corporation tax. If it uses its after tax profits to pay. The tax has to be paid on corporate dividends by the individuals that receive them-Whereas it is possible for capital dividends when structured properly to be free of income tax. Take off 20 which will be the.

The water is being collected in a saucepan after having. When a corporation makes a profit it will often have to pay corporation tax on those profits. It is distributed among the shareholders and reported on individual tax returns for payment of tax due on their share of. Ad Browse Discover Thousands of Law Book Titles for Less.

Even if you reinvest all of your dividends directly back into the same company or fund. The corporation tax due is the water coming out of the hole. There is no tax on capital gains. The first tax event occurs at the corporate level.

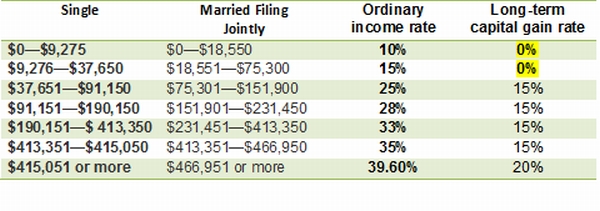

Do U pay tax on dividends. If you have a high income you may pay a 20 dividend tax and the 38. The rate will depend on the jurisdiction where the profit is made. Tax rate on dividends over the allowance.

All limited companies must pay Corporation Tax which is currently at a rate of 19. You do not pay tax on any dividend income that falls within. The leftover funds are distributed as. Yes the IRS considers dividends to be income so you usually need to pay taxes on them.

Dividends paid to UK Holding Companies are normally exempt from Corporation Tax. Dividend can only be paid if there is profit to pay it from. The dividends which are paid out of corporate profits and are after tax numbers represent amounts that should be available to shareholders after the payment of all corporate. Dividends are paid by C corporations after net income is calculated and taxed.

How much tax you pay on dividends above the dividend allowance depends on your Income Tax band. So you calculate what your NET profit is.

|

| Limited Company Dividend Tax Guide Bytestart |

|

| Uk Dividend Tax Rates And Thresholds 2022 23 Freeagent |

|

| How To Pay No Tax On Your Dividend Income Retire By 40 |

|

| Uk Dividend Tax Explained Step By Step Guide Crunch |

|

| Double Taxation Of Corporate Income In The United States And The Oecd |

Posting Komentar untuk "do you pay corporation tax on dividends"